How Mortgage Brokers Get Paid

Mortgage brokers are unique in that they are not usually paid through a salary nor by accepting an upfront paycheque from customers. Rather, lenders typically pay commissions for leading clients to their home loan products. Especially once a successful home loan application has been finalised.

How much does a mortgage broker cost?

Generally, someone looking to hire a mortgage broker's services is not required to pay, as they find their revenue through salaries or paid commission. Thus, for a customer, a mortgage broker often costs nothing at all.

Who pays the mortgage broker?

Many mortgage brokers get paid by the banks or lenders with whom they have secured a product from. Once a customer opts to apply for a specific home loan, the loan company will pay the mortgage broker commission rates based on their internal calculations. In the case a commission is not paid, a broker's business may cover their services with a salary.

Very rarely does payment come from the customers themselves. The only cases where a fee will be incurred are:

The loan balance is under $300,000

This situation leading up to acquiring a home loan is particularly complex

The loan will be paid off or refinanced within two years

The loan is for commercial or business means

How does a mortgage broker get paid?

The mortgage industry for finance brokers is varied regarding payment methods. While one business may pay their mortgage brokers with a set salary, others may rely on upfront commission payments from lenders.

Regardless of the payment model, most mortgage brokers get paid once a home loan has been signed and approved by the customer and lender.

Salary

Businesses paying a salary to their mortgage-broking employees is rare, but it still happens sometimes. Generally, when a salary is set, it is an annual base rate that is supported by commissions or bonuses.

Customers are never required to pay money towards a mortgage broker's salary. The responsibility solely lies with their business.

Commission

The most common way most mortgage brokers receive payment for their services is the commissions lenders pay to secure home loans with them. Different lenders may pay varied commission rates for smaller businesses, but most major banks and lenders pay the same rate to all finance and mortgage broking employees.

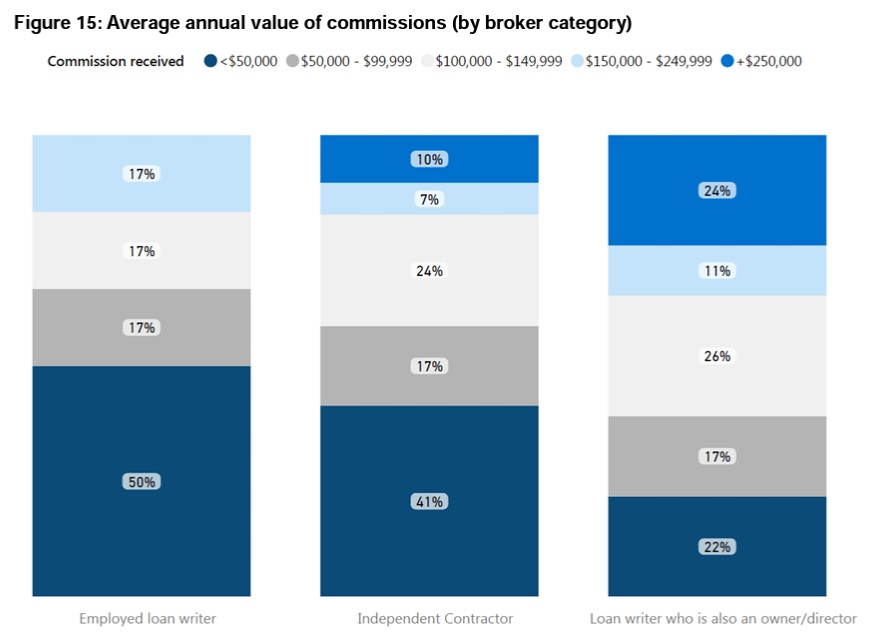

Source: https://download.asic.gov.au/media/4213629/rep516-published-16-3-2017-1.pdf

Bonus incentives

Some businesses may offer bonus incentives to their mortgage brokers when they earn specific or sizable commissions. These rewards generally come as additional pay or holidays but differ across business models.

This payment method from bankers and lenders has not occurred for many years. Previously, banks paid mortgage brokers bonus commissions based on the volume of loans sold from their business. However, the concerns of conflict between top-performing employees and others in the task force caused banks to retract this bonus incentive.

Factors influencing broker commissions

The total amount of a mortgage broker's commission payment is subject to change due to various factors. Their personal experience, the type of property being acquired, and even the current property market conditions may affect their commission paid.

Get a Better Rate prides itself on producing mortgage brokers at the top of the industry, backed by a reputable business for its empathy and dedication. These factors ensure that our brokers receive commissions that equal their hard work to secure the best home loan for you.

Type and value of the property

The location and architecture of the home in question often determine the total of a home loan. Luxury properties in highly sought-after areas will have a higher asking price than the average house, often raising the amount needed for home loans. In turn, this can raise the amount a mortgage broker will receive in commissions from the lender.

Is it cheaper to use a broker?

Overall, using a mortgage broker to find a suitable home loan over a major bank or lender is cheaper. Majority of broker services do not incur charges from customers. Even when they help you find the best home loan option for your personal and financial situation.

Mortgage brokers provide the same services any major lender would, along with additional advice or negotiation for:

Lower interest rates

An offset account

Ongoing fees and potential waivers

Redraw fees

Since a mortgage broker's services come without a fee, it is best to utilise their free advice to secure a home loan that will benefit you and your finances. In particular, their expertise and negotiation tactics can secure you a deal unavailable to the general public.

Types of mortgage broker commissions

Now that we have answered the question 'how do mortgage brokers get paid', it is time to delve into just what kind of commissions mortgage brokers earn through their hard work.

Mortgage broker commission rates are calculated as a percentage of the recently secured home loan's value to the lender. When a lender earns more through the fees and interest rate of a loan, they must pay more in commission to the mortgage broker.

There are three main types of mortgage broker commissions:

1. Upfront commissions

An upfront commission is paid once a home loan is agreed upon, averaging around 0.715% (+GST) of a home loan's value. This payment is generally given in the month after the broker settles the loan. Some lenders may also provide same week or month commission payment, but this is fairly rare.

For example, a home loan amount of $500,000 would result in a mortgage broker being paid around $3,575 for their services in securing the loan. This payment may be provided right after settlement, or it may take the full month before the brokers get paid.

2. Trail commissions

In contrast, a trail commission is a monthly payment to the mortgage broker throughout a loan term. This commission is usually calculated as 0.165% (+GST) of a home loan value, with the first instalment being paid a month after settlement and every month after that.

With the example of a $500,000 home loan, the trail commission rate of 0.165% comes to an overall payment of $825. If this home loan was to take a year to pay off by the customer, the overall trail commission payment would be split across 12 monthly instalments of $68.75.

By spreading the commission's payment across several months, a consistent source of income can be assured for those practising mortgage broking.

3. Clawback provisions

The clawback is one of the few fees a customer may have to face when obtaining a mortgage broker's services and may be used by a business model to pay their employees. This is not an upfront fee, but one that will be requested if you have repaid, refinanced or discharged your home loan within a set amount of time. This is usually between 12-24 months for most businesses.

Businesses request clawback fees because lenders will charge a business a penalty for introducing them to a short-term and unprofitable loan. This cost is covered by clawback charge fees, which may range between 0.35-0.85% of a home loan's value. The exact amount is identical to the amount that has been charged to a business from a lender.

Fortunately, Get a Better Rate does not require a clawback provision from our clients. Our services do not incur any hidden charges as we place our customers' needs before those of the lenders. No penalties will change this stance.

Alternatives to using a mortgage broker

Mortgage brokers are the most affordable and reliable means of finding a home loan service that supports your personal and financial situation. If you do not mind paying an upfront commission or fee, however, alternative means of applying for a mortgage exist.

Direct lending options

You can cut out the go-between by applying directly to a bank or lending institution for one of their loan products. While this option means less time is required to research potential loan options or find a broker you want to work with, it often means less flexibility and options of loan choices.

With a mortgage broker, you will have a reliable source of financial knowledge to advocate on your behalf to major lenders. Negotiations for interest rates or loan amounts can thus be more difficult to manage independently. Consequently, you may not receive the rates you hoped for when applying directly to a lender.

Online mortgage platforms

Convenience is the keystone of online mortgage platforms, but you are still locked in with a single lender when seeking a loan. In contrast to a mortgage broker, who has contact with multiple lenders in search of the best option for you, an online platform will place its needs first as a lender.

Speak to the experts at Get a Better Rate!

If you are ready to begin your journey towards finding your dream home, get started with the dedicated team at Get a Better Rate. Our mortgage brokers are at the forefront of Sydney's mortgage broking scene , offering quality financial advice at no cost.

Save your money for your new home loan by choosing the option you can trust for quality service and no hidden fees. Contact us for a free consultation and take your first step towards a brighter future!

FAQs

At what point should I see a mortgage broker?

Once you have decided that you want to buy a property, it is best to contact a mortgage broker immediately. From the get-go, you can receive professional guidance about the property market and your own finances, leading you to the loan of your dreams.

Can a mortgage broker charge a cancellation fee?

If you have utilised a mortgage broker's services but decided not to secure a loan, some brokers charge a cancellation fee to cover their time and effort.

Do mortgage brokers offer better rates than banks?

A broker's negotiating power to home loans means that many customers can enjoy lower interest rates or better features than those offered by a financial institution. However, it is always best to look at all options available before making your choice.