Compare Virgin Money Home Loans & Get Expert Advice

Navigating Virgin Money home loan options in Sydney?

Our platform allows you to easily compare products and access expert advice from experienced brokers to find the right loan for your needs.

Product rates and fees last updated 01 Jan 1970

Simplify Your Virgin Money Home Loan Search

Navigating the world of home loans, especially when considering your housing needs, can feel overwhelming. At Get A Better Rate, we make finding the right Virgin Money home loan simpler than ever. Our platform allows you to easily compare a range of Virgin Money products side-by-side, while our experienced Sydney-based brokers provide the expert guidance you need to secure a loan that truly fits your objectives.

Understanding Your Situation

Choosing the right Virgin Money home loan depends heavily on your individual circumstances and financial goals. Are you a first-time buyer, looking to refinance, or considering an investment property? Our experienced brokers take the time to understand your unique situation to recommend Virgin Money options that truly align with your needs and objectives.

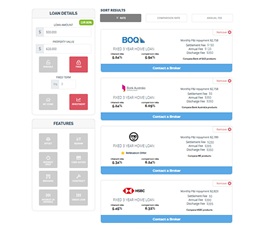

See How Virgin Money Compares to Other Lenders

While Virgin Money offers a range of home loan products, it's wise to explore all your options. Get A Better Rate allows you to compare Virgin Money's loans side-by-side with offers from over 40 other trusted lenders in Australia. See how their rates, fees, and features stack up to ensure you're getting the best deal for your situation.

Understanding Loan to Value Ratio (LVR)

Loan to Value Ratio (LVR) is a key factor when considering a Virgin Money home loan. It represents the amount of your loan compared to the value of the property you're purchasing or refinancing. A lower LVR (meaning you have a larger deposit or more equity) can often result in more favourable interest rates and may help you avoid Lenders Mortgage Insurance (LMI). Our brokers can explain how LVR applies to different Virgin Money loan products and help you understand its implications for your borrowing power.

Information for Home Owners

If you're looking for a Virgin Money home loan for your own home, features like offset accounts and redraw facilities can offer significant benefits. Virgin Money provides a range of loan options designed for home owners, allowing you to manage your finances effectively and potentially save on interest. Our brokers can help you explore these features and find a Virgin Money loan that suits your lifestyle.

Why Choose Get A Better Rate for Your Virgin Money Loan?

Finding the right Virgin Money home loan doesn't have to be a hassle. Here's how Get A Better Rate gives you the edge:

See Live Virgin Money Rates & Features

Our unique platform provides an easy way to compare various Virgin Money home loan products and their key features, helping you understand their different purposes.

Expert Virgin Money Insights

Our Sydney-based brokers have in-depth knowledge of Virgin Money's lending criteria and product nuances.

Compare Beyond Virgin Money

We don't just focus on one bank. We can compare Virgin Money's offerings against solutions from over 40 other trusted lenders, informed by your specific searches.

Receive Personalised Advice

We take the time to understand your unique financial situation and property goals to recommend the Virgin Money loan that truly suits your needs, considering factors like your potential borrowing capacity.

Simplify Your Application Support

Let us handle the complexities of the application process, helping you navigate the paperwork and liaise with Virgin Money, even explaining key documents like the product disclosure statement (PDS).

Contact Sydney mortgage broker

Need help comparing Virgin Money loans or navigating the application?

We have over 20 years of experience working with different Australian Home Loan providers, including Virgin Money. Speak with Get a Better Rate and have an experienced Mortgage Broker help navigate your next home loan. Based in the Sydney CBD, Get a Better Rate partners with over 40 top Australia Home Loan providers, reach out for a chat today!

Get a Better Rate is led by a seasoned professional in the hands of mortgage broker Peter Hammond. Peter has over 20 years of experience working with leading Australian financial institutions, including Westpac, Aussie Home Loans, Macquarie Bank, AMP, and Woolworths Money. His expertise in all mortgage lending matters makes him a reputable source of lending knowledge throughout Sydney and beyond.

Peter has worked across various roles, including product management, relationship management, operations and, more recently, as a consultant. This has given him a deep knowledge of the Australian home loan landscape and the challenges consumers face.

It is this connection and dedication to his clients that makes Peter such a trusted figure in the mortgage industry.

Need Help Comparing Virgin Money Loans or Navigating the Application?

Our expert mortgage brokers in Sydney are here to answer your questions and guide you through the Virgin Money home loan process.

Ready to Take the Next Step with Your Virgin Money Loan?

To help you prepare for your Virgin Money home loan application, whether you're building your future or buying into the property market, here are a few key steps:

Before you start the process, it's important to understand your goals and strategy. Whether you are refinancing to a lower interest rate, purchasing a new home or looking to renovate.

Use our home loan repayment calculator and compare repayments against your budget.

STEP 1

Gather Your Essential Documents

- Have your income statements (payslips, tax returns)

- Prepare your Expense budget

- Know your monthly liabilities and credit card limits

- Australian ID documents

STEP 2

Discuss Your Options with Our Virgin Money Specialists

Trusted Sydney Mortgage Brokers Helping You with Virgin Money Loans

At Get A Better Rate, we're committed to providing transparent and reliable mortgage advice.

Experienced Professionals

Our team of accredited mortgage brokers like MFAA and AFCA has years of experience assisting Sydney homeowners.

Local Expertise

Based in the Sydney CBD, we understand the local property market and have strong relationships with lenders like Virgin Money.

Client Success

Don't just take our word for it. See what our satisfied clients say about finding their ideal Virgin Money loan with us below.

Testimonials

Exploring Virgin Money Fixed Home Loan Rates?

Understanding the LVR can be crucial when considering fixed rates, as it can influence your options.

Fixed-rate loans offer the security of consistent repayments for a set period. However, it's important to consider factors like potential break fees and limited flexibility. Our expert brokers can help you weigh the pros and cons of a Virgin Money fixed-rate loan based on your individual circumstances.

Additional resources and tools

No matter what aspect of home loans you want to address with us, we have plenty of additional resources and tools to help you. Whether you want to compare home loans with the Virgin Money, calculate your loan repayments, or figure out how much you will save when you refinance your existing loan, Get a Better Rate has you covered.

Refinance Calculator

Our refinance comparison calculator, will help you understand what you could be savings on your home loan

Loan Repayment

How much will be loan repayments be?

Compare Loans

Compare hundreds of home loans from 40 different lenders